Beginner's Guide To Start Online Trading In The Indian Share Market

Learn how to start online trading of shares in India with easy steps. Get tips, tools, and strategies to succeed in the stock market.

Seekho Official

30 Sept 2024

Seekho Se SeekhoDownload the app for better experience

More from Seekho Official

Phone Hacks in India: Common Mobile Scams and How to Stay Safe

Learn about everyday phone hacks in India, how mobile scams work, and simple steps to protect your phone, data, and money. Stay informed and safe.

Seekho Official

5 Jan 2026

How to Check Phone Location on Android: Step-by-Step Guide

Learn how to check phone location on Android using simple, step-by-step methods. Find lost phones easily and use location features safely.

Seekho Official

5 Jan 2026

Step-by-Step Guide to Remove Your Google Business Profile Completely

Find out how to remove business from Google in simple steps and delete your Google Business Profile completely while keeping your reviews and data secure.

Seekho Official

5 Jan 2026

How to Start a Tour and Travel Business from Scratch in Simple Steps

Learn how to start tour and travel business from scratch with simple steps, legal tips, branding, marketing, and growth strategies for your travel agency.

Seekho Official

5 Jan 2026

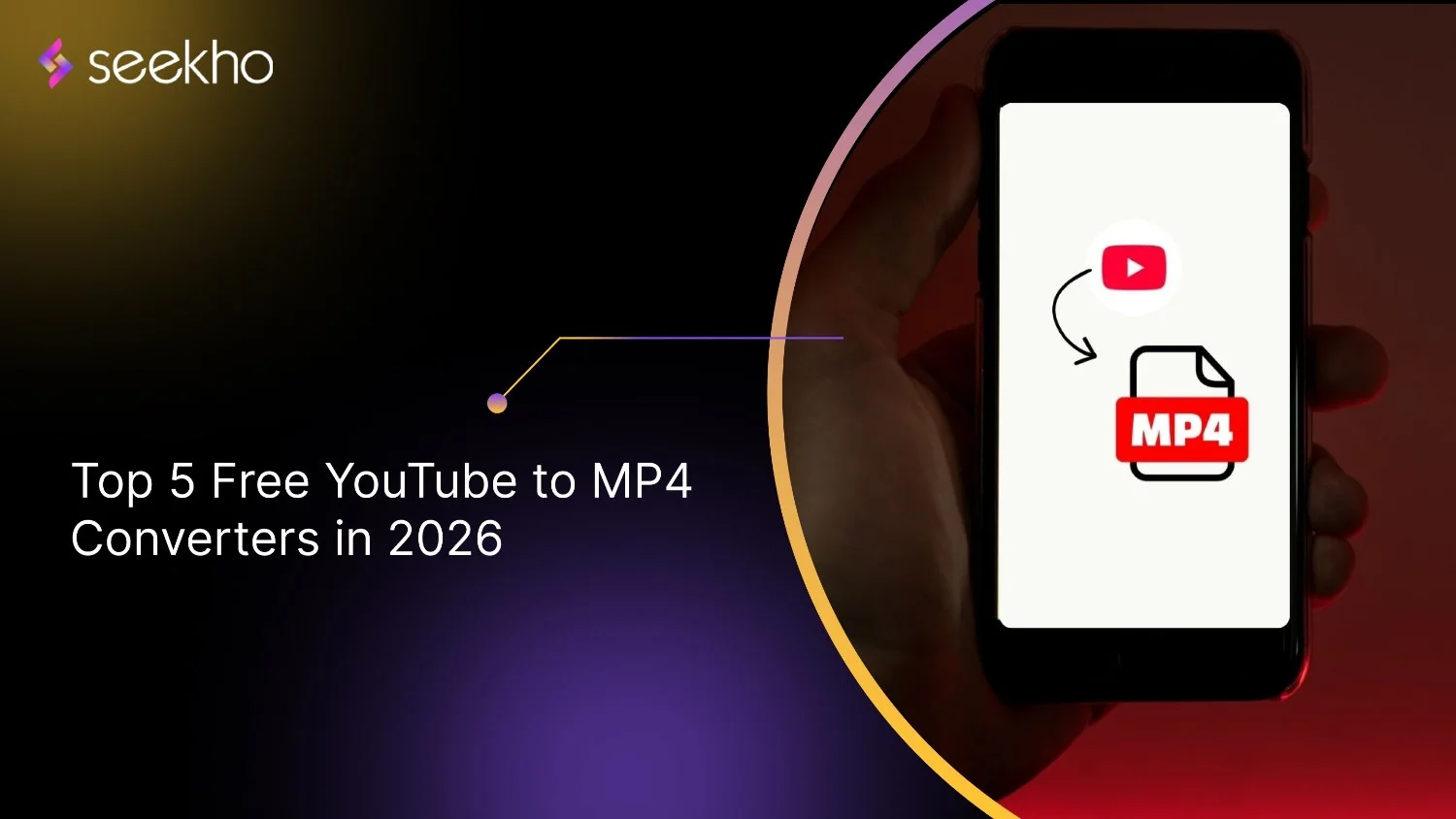

Top 5 Free YouTube to MP4 Converters in 2026

Learn how to use a Youtube to mp4 converter safely, compare free tools, avoid common mistakes, and download videos offline without losing quality or security.

Seekho Official

5 Jan 2026

How to Convert MP4 to MP3 with High Quality

Learn how to convert MP4 to MP3 with the right tools and settings to get clear audio, smaller file sizes, and high-quality sound without losing clarity.

Seekho Official

5 Jan 2026

How to Get into the Real Estate Business: A Simple Guide

Learn how to get into the real estate business with easy, actionable steps on choosing a niche, building skills, marketing, and growing your property venture.

Seekho Official

27 Dec 2025

Starting a Small Business in India: A Step by Step Online Guide

Learn how to start a business in India with a clear, step-by-step online guide covering planning, registration, finance, digital presence & launch tips.

Seekho Official

27 Dec 2025

How to Start Trading Business in India: Legal Steps, Capital, and Common Mistakes

Learn how to start a trading business in India by choosing your niche, setting legal structures, and ensuring compliance. Start trading effectively!

Seekho Official

27 Dec 2025

7 Common Mistakes to Avoid During F&O Tax Calculation

Learn F&O tax calculation covering business income rules, ITR forms, audit limits, expense deductions, and loss carry-forward for accurate reporting.

Seekho Official

27 Dec 2025

© 2026 Keyaro Edutech Pvt Ltd. All rights reserved.